In this fertiliser report, Argus Media provides an update on urea prices and imports, CSBP’s increased liquid fertiliser production and strong sales, cautious phosphate market activity amid awaiting price movements, and the restart of the Ardmore phosphate mine.

Urea

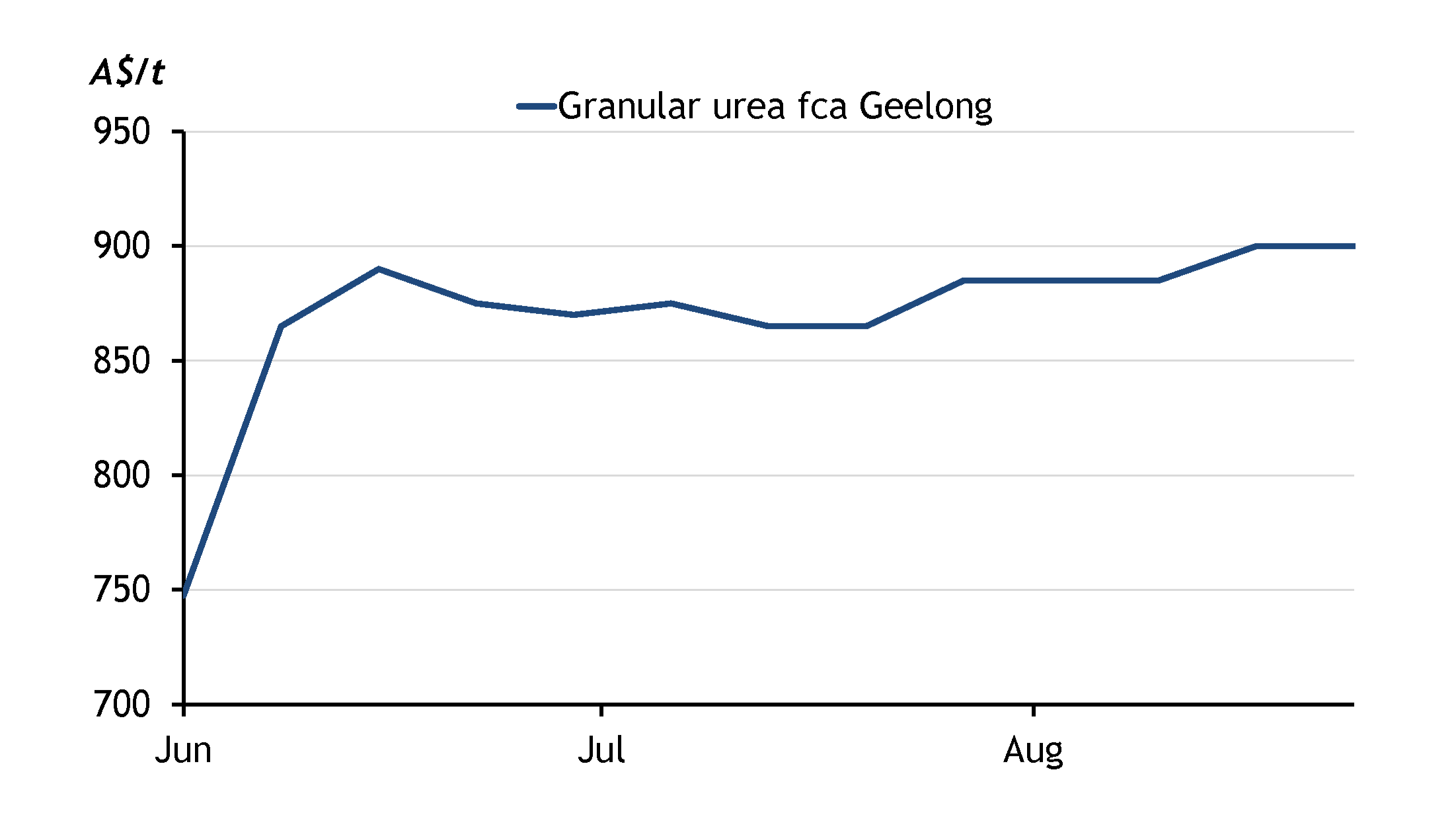

Some demand for granular urea has arisen because of favourable rainfall, keeping local prices steady. However, strong local prices are keeping some retailers from entering the market.

Granular urea was assessed at A$890-900/t fca Geelong. CSBP lowered its urea price to A$951/t ex-Kwinana from A$1,004/t ex-Kwinana as of 2 September.

All major growing areas apart from southwestern South Australia are likely to receive some rainfall, according to the Bureau of Meteorology. This could encourage some late nitrogen application for the winter crop.

CSBP has increased its production of Flexi-N, its liquid fertiliser containing urea, ammonium and nitrate, according to its Spring Ag Insights. Production at its Kwinana Distribution Centre has increased by approximately 20%, and its Geraldton and Esperance Distribution Centres are scaling up.

Australian urea imports for January-July are down by 2% on the year earlier, totalling around 2.9 million tonnes, according to trade data from the Australian Bureau of Statistics. Imports from Indonesia dropped by 53% in the same period, and Brunei imports increased 238% because of no trade from April to July in 2024.

Wesfarmers

Australian manufacturer CSBP's fertiliser sales rose in the 2024-25 financial year ending 30 June. The manufacturer's fertiliser sales came in at 1.48 million tonnes, up by 22.8%, from approximately 1.21 million tonnes the year before. CSBP's fertiliser revenue rose by 20.8% to A$1.12b ($730.2m) from A$927m.

Phosphates

Australian importers of MAP are eager to start their buying programs but cannot proceed without interest from local farmers.

Farmers are still waiting for international free on board (FOB) prices to lower, despite buying usually starting around this time.

Ardmore phosphate mine restarts

The 635,000 t/yr Ardmore phosphate mine has resumed operations after Australian phosphate producer PRL Group satisfied all conditions for the takeover of local miner Centrex and its subsidiary Agriflex.

Operations at the Ardmore mine have restarted and customer shipments of phosphate product will begin before the end of 2025, PRL said on 4 September.

Commentary and pricing supplied by Argus Media

Disclaimer: The information provided in this report is general in nature and is intended for informational purposes only.