Urea

The local granular urea market is primarily unchanged, with no major demand.

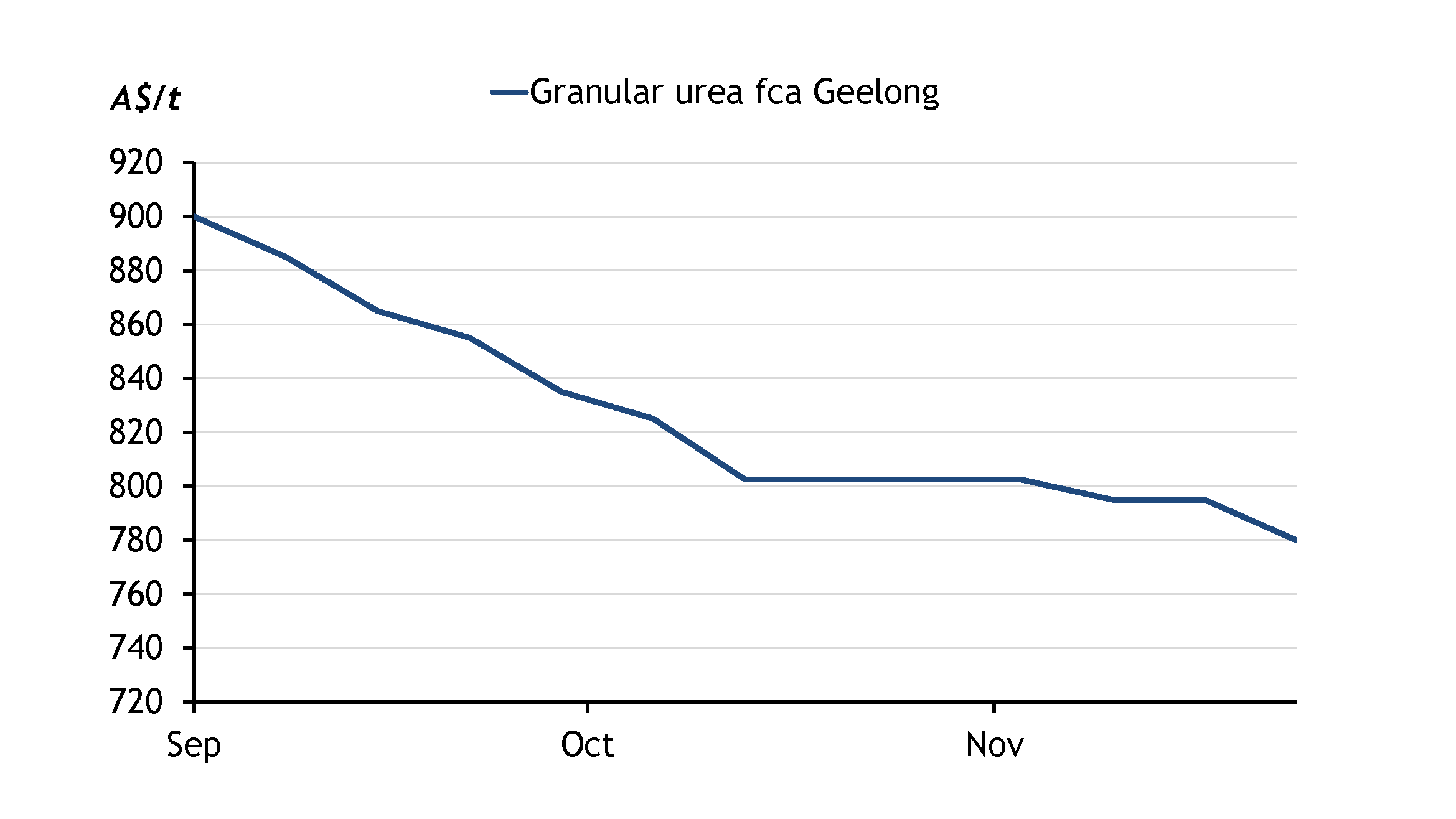

Argus last assessed granular urea at A$770-790/t fca Geelong because of continued low demand.

Urea imports for November are at 154,000t, according to vessel tracking data from Kpler. This is a 188% increase from November 2024, according to the Australian Bureau of Statistics (ABS). However, January-November imports in 2025 are down 8% from the year earlier, according to data from the ABS and Kpler.

Planting for the summer crop is coming to an end for several crops across Australia. On the East Coast, this includes corn, cotton, rice, soybeans and sunflower seed, according to the US Department of Agriculture. Local demand for urea has primarily been from Queensland’s summer crop in the last few months.

Phosphates

Local demand for phosphates continues to grow, but MAP buying has been slowed by falling international free on board (FOB).

There are 165,800t of MAP/DAP in transit to Australia over five vessels, according to Kpler.

PRL restarts phosphate rock exports

Australian phosphate producer PRL has shipped the first rock from its newly acquired 650,000 t/yr Ardmore mine, the first exports from the project in nine months.

The 25,000t shipment left the Port of Townsville on 26 November and is destined for New Zealand, the Port of Townsville said. The vessel will reach the Port of Napier on 4 December, Napier Port data shows.

SO4 to ramp up Lake Way SOP production

Australian SOP producer SO4 plans to debottleneck the SOP process plant at its Lake Way project in Western Australia by the end of January-March 2026, aiming to gradually ramp up production to its nameplate capacity of 220,000 t/yr.

Commentary and pricing supplied by Argus Media

Disclaimer: The information provided in this report is general in nature and is intended for informational purposes only.