Connecting the Dots: Improving Australian Grain Supply Chain Efficiency

Freight costs account for 30% of the price of grain at port.

In GrainGrowers’ 2023 Annual Policy Survey, Grain Freight and Supply Chains were identified as a key concern for growers, with over a quarter of challenges falling under this category.

To remain competitive, increased supply chain efficiency is required to reduce costs for growers. Australia needs a freight network that can export grain as quickly and efficiently as possible to capture high international prices during times of reduced global supply.

GrainGrowers has commissioned a report that highlights the key areas that are impacting freight efficiency, reducing grower profitability, and affecting international competitiveness.

Download the full report

Connecting the Dots: Improving Australian Grain Supply Chain Efficiency was compiled by independent global strategy consultancy L.E.K.

The report highlights six key areas that are impacting freight efficiency: road funding, bridge infrastructure, road regulation, rail, supply chain data and port connectivity.

For Minyip grower Ryan Milgate, key bridge infrastructure isn't up to scratch when it comes to meeting local demand.

"We have a road either side of the bridge, rated for high-productivity vehicles, which is fantastic, but we have this bridge right in the middle as a bottleneck where legally these vehicles can't pass over."

For Moora grower Tracy Lefroy, inadequate road funding means increased freight costs, delays in getting crops to market and safety concerns.

"Rather than just patching potholes, it is vital that we use this opportunity to invest in improving the long term resilience of our nation's freight networks."

Heavy vehicle road regulations, such as costly and lengthy permit requirements, are constricting the efficiency of grain freight.

For Condamine grower Ben Taylor, these constraints have impacted his farm business.

"The extra cost burden and lengthy application process for permits must be addressed by government and regulators to improve efficiencies and costs that growers, transport operators and consumers all eventually endure."

Six areas impacting grain freight efficiency

Road funding

Systemic long-term underfunding has left Australia’s regional road network in an extremely poor condition, with most government charges directed to consolidated funds.

Bridge infrastructure

Across Australia, thousands of bridges require replacement, with relatively low load limits restricting modern larger freight vehicles and impacting efficient access on key grain freight routes.

Road regulation

Costly and lengthy permit requirements constrain higher-capacity vehicles transporting grain across multiple locations (farm gate, local roads) outside the heavy vehicle networks, magnifying inefficiencies in heavy vehicle road regulations.

Rail network regulation

A patchwork of track gauges, axle loads, rail infrastructure managers, and regulation significantly reduce rail freight efficiency, creating extensive operational complexity and increasing costs to grain growers using the network.

Supply chain data

Stakeholders require robust, publicly accessible data to provide performance transparency, mitigate disruptions, drive day-to-day improvements, and inform policy, long-term investment, and other strategic decisions.

Port connectivity

A mix of rail and road access and land use planning constraints at major bulk grain ports hampers efficient access for grain exports, which amount to approximately 75% of grain production.

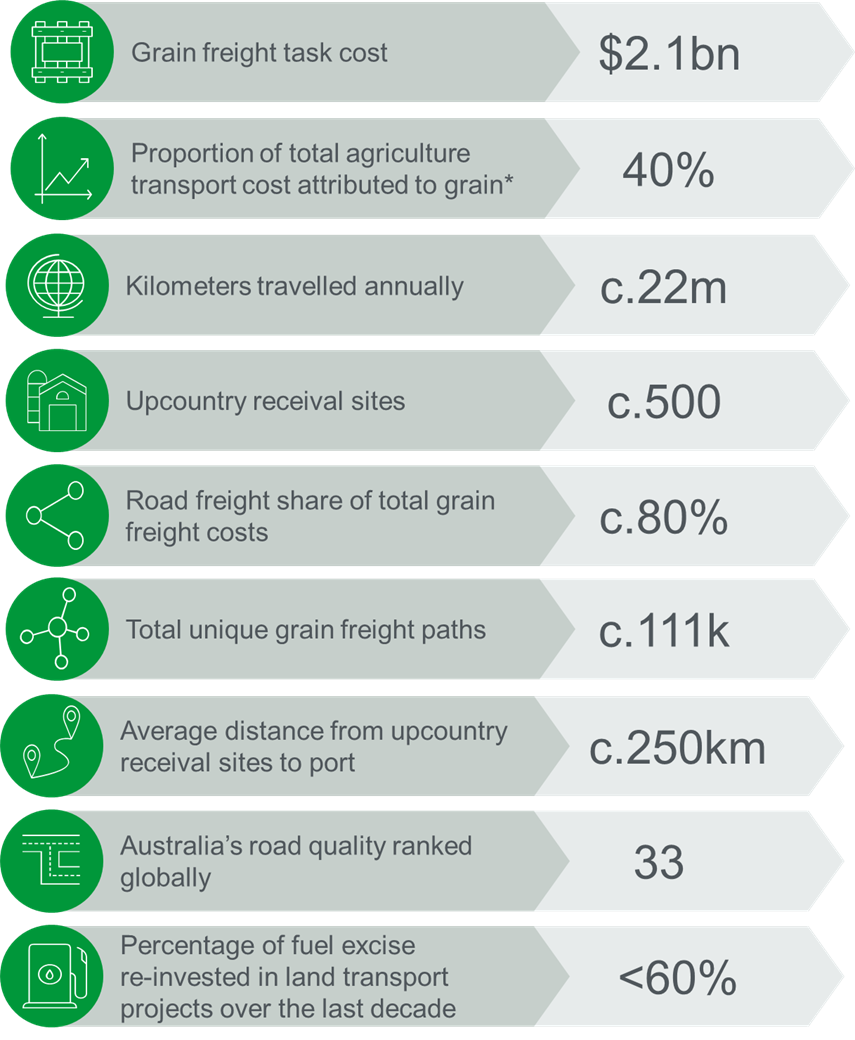

Industry at a glance

46mtAnnual grain production

22,000Grain growers

$2.1bnGrain freight task cost

30%Proportion of growers' costs attributed to transport

Grain transport costs more than $2bn annually

Australia’s recent record harvests have demonstrated the limitations of the current capacity of the network, in particular moving grain from site to port.

With the national crop size expected to grow, Australia faces the challenge of significantly increasing current network capacity to move grain from site to port to increase export capacity.

In the face of global competition and on-going innovation, industries that stand still will lose market share and suffer declining returns. This report identifies that there are many opportunities for the grain sector to improve the supply chain, continue to lift its performance and maintain its competitiveness as a key sector of the economy and contributor to global food supply. But that will require a vision, a clear action plan, collaboration and investment.

Maximising the grain supply chain’s potential requires coordinated investments of capital, time and effort into policy, funding and operational optimisation. We will be looking at how to prioritise issues and what we firmly believe are the critical next steps.

Rhys Turton

Addressing supply chain issues

The report points to the record winter crop production of 65.7 million tonnes in 2022-23, illustrating the significant impact of high supply chain costs affecting growers and threatening the global competitiveness of the Australian grain industry.

To remain competitive and reduce costs for growers, Australia needs increased supply chain efficiency.

Growers need a freight network that can export Australia’s grain as quickly and efficiently as possible to capture high international prices during times of reduced global supply.

Maximising the grain supply chain’s potential requires coordinated investments of capital, time and effort into policy, funding and operational optimisation.

GrainGrowers is now developing a comprehensive strategy to drive improvements and efficiency and help ensure competitiveness and profitability for Australian growers.

Grain freight and supply chains

Freight costs account for 30% of the price of grain at port. Australia's global competitiveness is limited by the cost of transporting grain and efficient supply chains are critical for future industry success. GrainGrowers is driving an agenda to improve access to and efficiency of the grain supply chain.