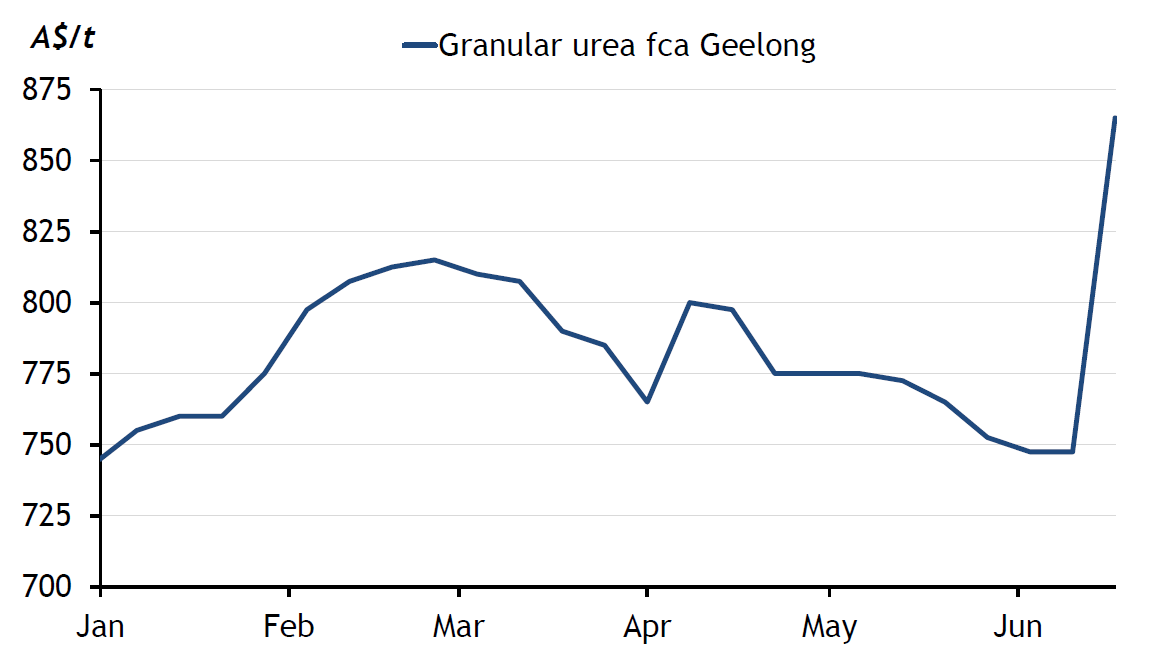

Urea price surge

Domestic urea prices surged on the back of rising international Free On Board (FOB) prices because of hostilities in the Middle East, and prompt supply tightened on increased demand. Egyptian urea output was halted on 13 June and Iranian urea production went offline on 19 June, pushing FOB prices to highs.

Domestic urea prices in Australia rallied almost as fast as international prices as suppliers raised their offers on a day-by-day basis. Retailers that previously hesitated to buy from importers because of weak domestic demand rushed into the market to procure supplies on fears of further price rises. Tonnes of urea were reportedly sold as high as A$865/t fca Geelong, up from A$745/t - A$750/t the previous week, while at least two suppliers were heard offering urea as high as A$900/t in Victoria, although buying appetite at level subsided.

While urea stocks inside Australia are healthy, suppliers had started selling tonnes for delivery in 1-3 months time over the previous month, thanks to sluggish local demand. This has led to at least one supplier running out of tonnes for prompt sale and delivery after buyers came to the market this week. Australian urea prices are expected to remain elevated on the back of favourable rainfall forecasts, which are encouraging farmers to enter the market where prompt supply is already squeezed.

Although the steep climb in FOB prices has reversed, prices remain at elevated price levels as India has entered the market, issuing a tender to buy 2 million tonnes of urea.

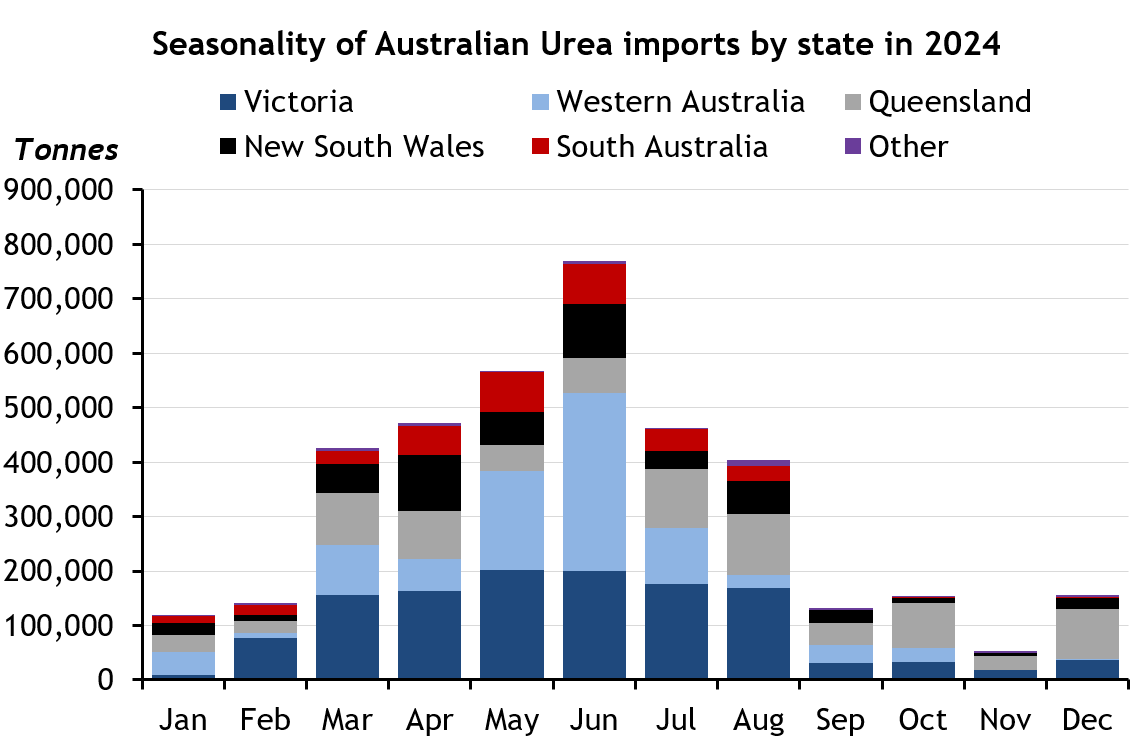

The urea market in Western Australia may tighten moving forward, but a price spike as severe as on the East Coast is not expected. This is because most of Western Australia's urea imports have already arrived in the country or left the Middle East prior to the conflict.

Australia’s reliance on urea imports from the Middle East

Over half of Australia's urea imports, nearly 4 million tonnes in total, came from suppliers in the Middle East such as the UAE, Saudi Arabia, Qatar and Bahrain in 2024, according to the Australian Bureau of Statistics. Australia's urea imports typically peak in June, before trailing off towards the end of the year. Around 1.36 million tonnes or 35pc of total imports were imported in the second half of 2024.

Phosphates

The Australian phosphate market has been insulated by rising FOB prices as the import window for phosphates usually ends in April before the country starts exporting phosphate fertilisers until the final quarter of the year.

Commentary and pricing supplied by Argus Media

Disclaimer: The information provided in this report is general in nature and is intended for informational purposes only.