What is GrainGrowers position?

GrainGrowers supports the Australian Government’s decision to appeal the unfair and unsubstantiated tariffs, this includes through WTO dispute.

Who will pay for WTO action?

Previously the Government has never charged an industry for taking a case to the WTO through the application of levies. There may be an in-kind cost to industry organisations like GrainGrowers for the provision of information and data to support the Australian Government’s case.

What has happened to Australia's barley market?

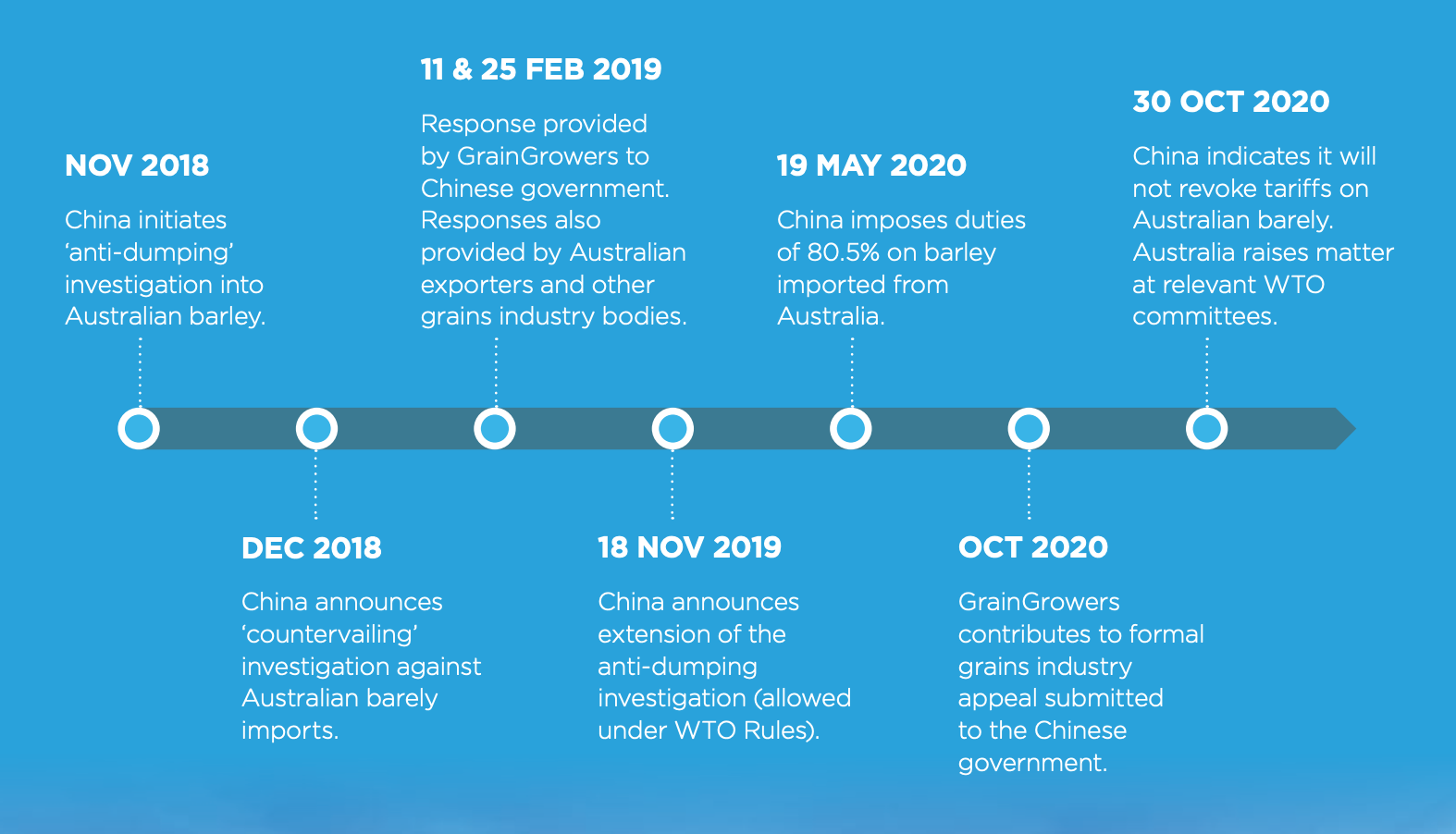

In late 2018, China made allegations that Australia was dumping barley into the Chinese market claiming that Australian barley was being sold at a price below the price charged for the product in Australia. China also made countervailing claims, arguing that Australian grain production was being subsidised through a range of government programs. Based on information provided both these claims are unfounded and have been appealed through the options available to date.

Are Australian farmers subsidised?

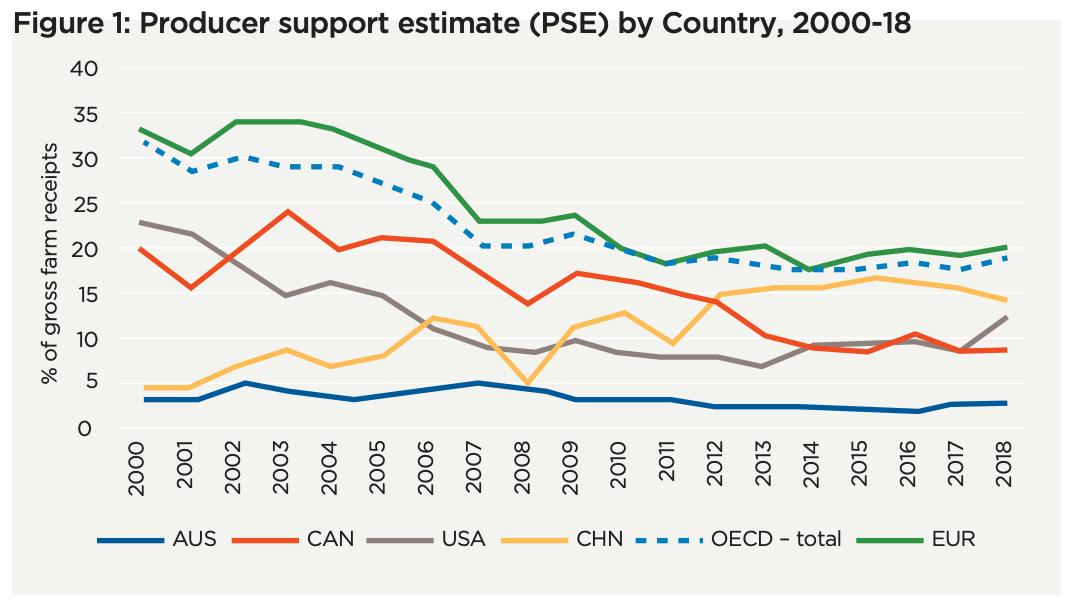

The OECD collects data to provide regular updates and estimates on levels of farm support provided in countries around the world. When looking at Australia, Canada, the United States, China and the EU from 2000-18, Australia received an average of 3% of their gross farm income as support. Australia’s is the second lowest (just behind New Zealand) of countries monitored by the OECD and had been steadily reducing over the last two decades. A full outline can be found here.

GrainGrowers has closely analyzed the specific programs that were claimed as providing subsidies to grain production in Australia during the investigation by China into Australian barley production. The programs identified would have provided very little direct benefit to grain farming businesses and have not subsidized production of barley in Australia.

What have the tariffs meant for Australian barley growers?

The announcement of the tariffs was deeply disappointing and will cost barley producers an estimated $2.5billion over the next five years, as Australian barley is diverted to other markets. These tariffs have disrupted and effectively halted barley export to China with the price of Australian barley artificially increased, making it uncompetitive in the Chinese market. The tariff announcement was made during sowing of the 2020 crop, and for most farmers it was too late to substitute for other crops. Growers will reconsider the volume of barley in their future plantings with considerations to markets, agronomics and logistics planning. ABARES December 2020 crop report forecasts barley production at 12 million tonnes this year, the second highest on record. Growers will be deciding whether to store the grain for later sales or sell at harvest.

How much barley has Australian exported to China in previous years?

The Chinese market accounted for 60-70% of Australia’s barley exports. Australian malt barley has been developed to suit the needs of Chinese maltsters.